In the post pandemic era, the Chinese economy has shown a resilient recovery trend. In 2023, Chinese Gross Domestic Product (GDP) exceeded 126 trillion CNY, a year-on-year growth of 5.2%, ranking among the top in the world’s major economies. It continues to be an important engine for global economic recovery, demonstrating the potential of the Chinese economy and keeping consumers cautious and optimistic about the development of the industry.

Looking back to 2023, the PeopleSearch Consumer Goods team summarized the past changes and future visible development directions of the consumer goods industry from three dimensions: enterprise dynamics, channel trends, and the industry talent market, bringing sincere work ——

PART 1 Keywords of 2024

01 Localisation

Applying Local Executives

Local personnel can foster stronger relationships with domestic customers, partners, and government agencies, establishing a solid groundwork for the company’s expansion in China.

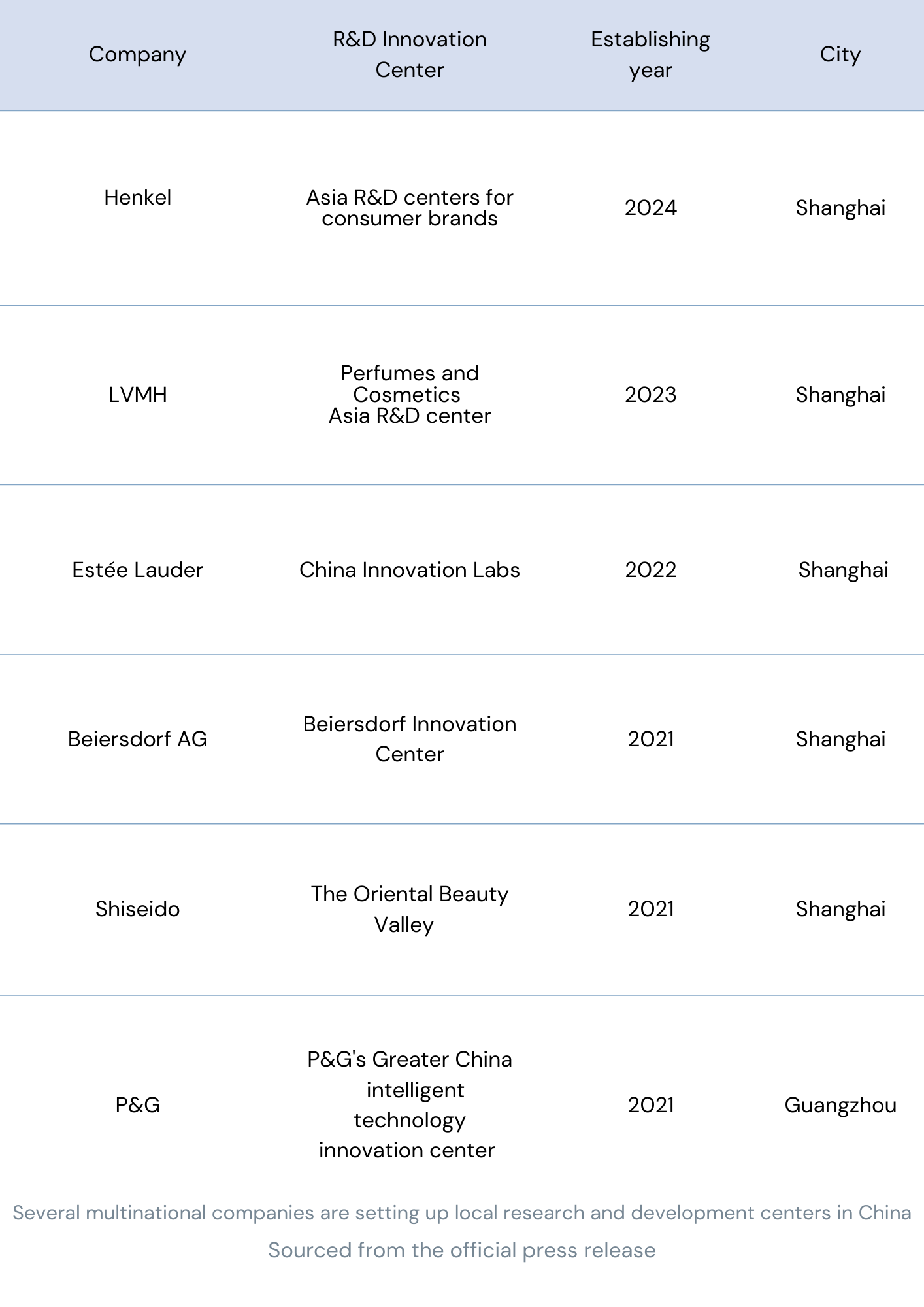

Investing in Regional R&D Centers

Building Local Brand

Pernod Ricard’s launch of The Chuan in December 2023 marked a significant milestone in localising their brand in China, exemplifying a growing trend among international brands to adapt to local markets.

02 Cross-Industry Collaborations

Cross-industry collaboration is an escalating trend among emerging consumer brands, spanning sectors like film, animation, gaming, collectibles, and luxury goods. The objective is to align with the preference of young consumers, capture the youth market, and facilitate mutual traffic growth.

03 Strategic Acquisition

The report contains many real-life cases of brands saying “love is better than competition”, which can be divided into two categories based on the purpose of corporate behavior:

Portfolio Expansion:

General Mills Group Added Pet Track (Enhanced Product Line)

Mondelez International invested in local food company Evirth (Product innovation)

Operational Transformation:

Baozun acquired GAP

04 Wellness Focused

A new report by CBD Data, “2023 China Healthy Living Trend Insights Report”, examines the current health concerns among Chinese consumers. The report highlights growing interest in various aspects of health, including sleep, diet, exercise, respiratory health, and scalp. Therefore, top companies are constantly launching new products around the concept of health.

Lay’s, a leading potato chip brand owned by PepsiCo, has recognized the growing demand for healthier snacks.

This strategic move demonstrates Lay’s commitment to adapting to consumer preferences and using that knowledge to improve their products.

By focusing on innovation and exploring new possibilities, Lay’s is not only offering healthier choices, but also building a stronger reputation in the market.

05 Chinese Beauty Brand On The Rise

Proya is revitalizing and modernizing traditional Chinese beauty brands

Joy Group fully manages all operations of the Rene Furterer brand in China

PART 2 Channels Analysis

01 Online Platforms

Alibaba: Strategic Shift

With the continuous development of the e-commerce market and fierce competition among various brands, the traffic dividend is gradually weakening, and the market growth rate is relatively slowing down.

Against this background, Ma Yun pointed out that the next opportunity is Taobao, not Tmall. He proposed “back to users, back to Taobao, and back to the Internet“, pointing out the strategic direction for Alibaba enterprises to face current challenges.

JD.com: Leveraging its Advantages

1. Deepening expertise in their main product categories

JD.com has established itself as a leader in specific categories like electronics (3C), home appliances, and maternity and infant products. They achieve this by consistently delivering high-quality products and exceptional service.

2. Jing Dong Jing Zao

While JD.com is known for its strengths in quality and service, high logistics costs can pose a challenge in lower-tier markets. These costs can make it difficult for JD.com to compete on price with other platforms, potentially hindering market penetration.

Pinduoduo: A Rising E-commerce Powerhouse

Taking advantage of post-pandemic consumer trends and a cooling market for consumer goods in urban areas, Pinduoduo’s innovative approach resonated strongly with price-sensitive demographics.

Douyin: Revolutionizing E-commerce Growth for Businesses

Douyin e-commerce has introduced the FACT operation matrix, consisting of Field, Alliance, Campaign, and Top-KOL components.

Little Red Book: Blending Social Media and E-commerce for a Seamless Shopping Experience

Today, Little Red Book is a powerful platform for content seeding and social e-commerce, especially among younger demographics.

02 Offline Channels

The Changing Landscape of China’s Snack Industry: Omnichannel, Innovation, and Aggregation

This move has fueled innovation in the sector. New retail formats, like bulk snack stores, are emerging to cater to changing consumer preferences, particularly among younger demographics who value convenience and variety.

Rapid development of Membership stores

Costco has opened its sixth membership store in China.

Sam’s Club has opened more than 40 membership stores, covering major cities like Shanghai, Beijing, Shenzhen, Suzhou, and Hangzhou.

Leveraging Distributor Partnerships to Enhance Channel Performance

In 2024, Yuanqi Forest is prioritizing distributor rights and empowerment by providing institutional support aimed at creating a conducive environment for distributor sustainability.

PART 3 Talent Market

01 Job Market in 2024

In this environment, companies are adopting a highly selective approach to hiring. They seek versatile candidates who can deliver substantial value at a reasonable cost without compromising quality.

02 Recruitment Insights

Buyer’s Market

Faced with a buyer’s market where the supply of talent far exceeds the demand for jobs, competition among job seekers has become more intense.

While the number of job seekers surged by 30% in 2023 compared to the previous year, job openings have plummeted by a staggering 50% during the same period. This stark contrast has created a buyer’s market for employers, intensifying competition among job seekers.

Priorities Among Candidates

Candidates today highly prioritize factors such as work environment, company culture, and personal growth opportunities when applying for jobs, leading them to place greater emphasis on platform stability.

If you’re interested in gaining professional insights such as salary guidelines for various functional departments, learning more about popular positions in the consumer industry, or if you have recruitment or job seeking needs, we warmly invite you to reach out to Tina at PeopleSearch!

Leave A Reply