Since Covid-19, the global trade ecosystem has been making a dramatic digital pivot, but to keep the momentum going, businesses need to urgently re-evaluate their approaches to human capital and hiring, say PeopleSearch Singapore’s Ng Se Wei and Gilbert Ong. Among other things, this involves making transformation palatable, nurturing the growth of “hybrid professionals” and hiring specialists from other industries.

The pace of digitalisation within the global trade ecosystem has been dramatic since Covid-19.

By

Many of us think nothing of buying groceries, electronics and other products and services online or on mobile apps. This is why consumers are often shocked to find out that up until recently, the complex system of global trade was heavily dependent on manual processes and paper documents.

Consider the use of paper in Trade Finance. For as long as countries have traded across borders, companies and financial institutions have been inclined to use physical documentation to manage the risks associated with limited visibility and possibly, weak relationships with counterparties. Even today, the vast majority of documentation such as invoices, bills of lading or inspection certificates are paper-based – four billion pages and documents annually. While container shipping has graduated to electronic architecture, the use of paper has clearly endured in trade finance.

Covid-19 has certainly added to the urgency to digitise, and the hope is that companies and institutions will continue to see the merits of digitising documents, streamlining processes and using technology to tackle inefficiencies.

A recent Accenture report, Global Trade’s New Norm: Why Banks Must Transform Trade Finance & Supply Chain Finance points out that “automating existing processes will cut risk, boost revenues and improve customer satisfaction, as well as lower banks’ exposure and risk, and position them strongly for the future.”

The writers recommend solutions such as “smart” automation systems that combine Optical Character Recognition (OCR), robotic process automation, AI and natural-language processing. These systems can rapidly read documents, comprehend words and learn from manual corrections.

In the realm of Supply Chain Management, drones and robots are becoming more ubiquitous in warehouses and while airplanes, steam ships and trucks are still being used, transportation vendors are being chosen based on how green they are.

THE HUMAN FACTOR

Amid these advancements, let’s remember that many of these technologies could have been deployed and applied much earlier.

A crucial factor delaying their widespread use is a vital resource at the heart of global trade and its inter-connectivity – people. More specifically, it is people’s entrenched habits and comfort with the status quo.

A 2017 ICC Banking Commission report highlighted that nearly 44 per cent of respondents identified priorities linked to digitisation and technology as strategic priorities. But while 50 per cent anticipated high levels of digitisation within a decade, the other 50 per cent expected it to take 10 to 25 years.

This apparent lack of confidence in transformation is certainly reflective of the lack of enthusiastic support for related initiatives. Hopefully, Covid-19 changes this for the long term.

However, we firmly believe that the business community should refrain from the destructive cycle of getting comfortable with the status quo and only springing into action in the face of a threat such as a global pandemic. Those working in the ecosystem of global trade must have the foresight and courage to embrace technological advancements ahead of time – crisis, or no crisis.

Now, more than ever, considering the challenges ahead, such changes need to stick.

MAKE CHANGE PALATABLE

The key to widespread adoption lies in making change palatable.

The success of e-payment models in China holds many lessons in this regard.

For one thing, potential frictions were reduced. Enabling self-enrolment for both customers and merchants, increasing Know-Your-Customer standards only to the extent it was necessary to do so, enabling merchants to get on board instantly through the use of in-app QR codes and keeping transaction fees negligible greatly helped boost adoption in China.

Similarly, entities operating in the global trade system can use highly responsive interfaces and eliminate transaction fees for new merchants, increasing them to modest levels only as volumes increase.

Let’s face it, at the end of the day, digitalisation only yields benefits if the people factor is holistically addressed.

THE CURRENT STATE OF GLOBAL TRADE

Some question if we should be in a hurry to concretise changes, considering the state of global trade today.

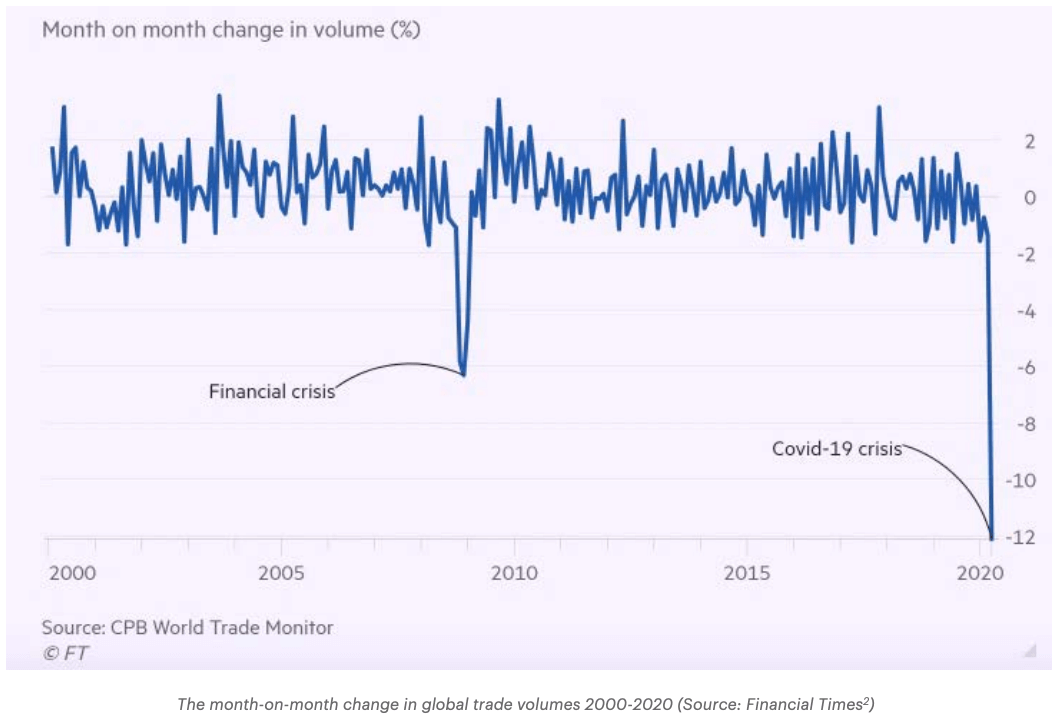

Prior to 2020, aside from during the 2008 global financial crisis, fluctuations in global trade volumes were modest at best.

With Covid-19, shock waves reverberated across the system (refer to chart) and the impact is likely to continue. Notably, supply chains, hit by dramatic changes, will have to continue adapting to geopolitical challenges including a move towards deglobalisation in some regions.

Aside from the pandemic, US-China trade tensions and the fallout from Brexit added an indisputable complexion to the ecosystem.

Today, it might be tempting to cite the early moves of the Biden administration as reasons for optimism, but experts warn that we have to be prepared for uncertainty to persist.

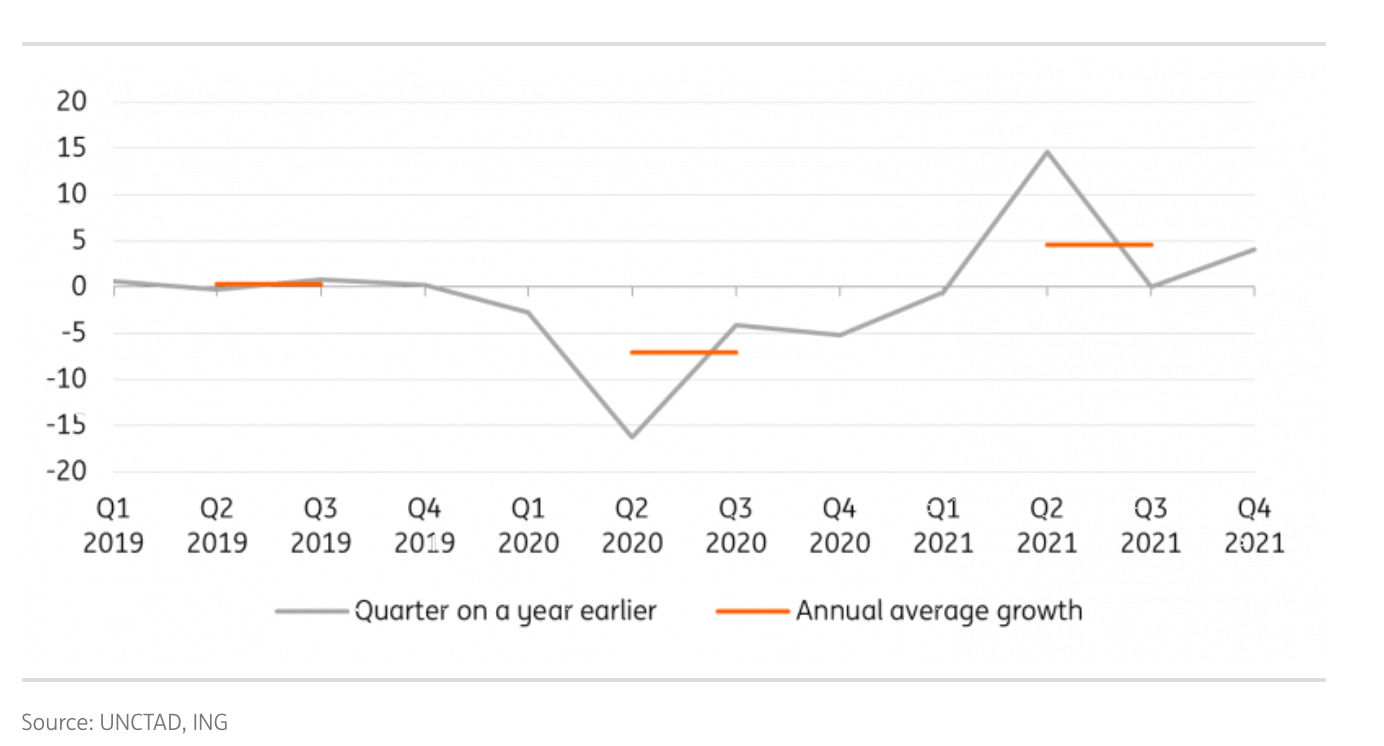

According to ING, with a Covid-19 vaccine, trade will rebound “but some Covid-related disruptions to transport capacity will take time to unwind, and cause a persistent drag even as demand recovers.” ING forecasts a 7 per cent fall in goods trade volumes in 2020 followed by growth of around 5 per cent in 2021, to reach pre-pandemic levels only in early 2022 (refer to chart).

Nevertheless, we believe the current state of affairs should continue lending impetus to the modernisation of global trade infrastructure specifically in terms of Logistics and Supply Chain Management, and Financing capabilities.

Covid-19 will certainly not be the last crisis humanity faces and the changes occurring in the ecosystem today can certainly be scaled-up to facilitate expected resurgence in global trade in the near future.

PARTNERSHIPS ARE CRUCIAL TO SOLVING PROBLEMS

However, for long-term success and sustainability, aside from ensuring that the people who operationalise global trade are willing to embrace change, the information and resource asymmetry that is that common in the Supply Chain Management and Financing industries needs to be addressed.

Smaller entities often do not have formal financial records, or access to formal credit channels. This increases credit costs and lending risks which in turn, prevents them from growing.

To end this vicious cycle, FinTech and Software as a Service (SaaS) companies are helping with the use of artificial intelligence (AI) and alternative data sources. They are able to compile unstructured or informal data to understand businesses’ cash-flows. Based on this, a lender can underwrite short-term loans, for 30, 60 or 90 days.

This demonstrates the benefits of partnering across sectors. Better access to data and bank-FinTech partnerships will make financing cheaper.

Similarly, within the Supply Chain ecosystem, partnerships can be greatly beneficial. For example, with increased digitisation, farmers can use devices powered by the Internet of Things (IoT) to monitor soil moisture in order to make more informed decisions on the optimum time to plant or harvest. In turn, this could help manufacturers or even distributors come up with more accurate production and pricing forecasts.

However, IoT devices only work if they are installed properly and should only be handled, attached or removed by trained people.

Considering this, various types of expertise are required to manage the supply chain as a whole.

TALENT ACQUISITION: BEING AWARE OF YOUR NEEDS

In light of these changes, companies must reconsider their talent acquisition strategies.

Experts have pointed out that while CEOs are often clear about their revenue forecasts and business targets, when asked to describe the type and scale of human resources needed to achieve these targets, they are at a loss.

In a 2009 Harvard Business Review article, The Definitive Guide to Recruiting in Good Times and Bad, Boris Groysberg, Richard P. Chapman Professor of Business Administration at Harvard Business School, Nitin Nohria, Dean of Harvard Business School, and Claudio Fernandez-Araoz, an executive fellow at Harvard Business School said that CEOs they spoke with had difficulty “making predictions for the size and composition of their top-x groups.” x refers to the number of “senior executives constituting the critical leadership pool in the company.” Even with the help of their human resources heads, they could not do so. In other words, there was absolutely no “strategic talent plan.”

This needs to stop.

The researchers advise that “the first step in establishing a sound recruitment process is to recognise that your firm’s existing top-x pool is probably inadequate. Despite your best efforts, some top talent will leave to pursue other opportunities.”

RECRUIT FROM OTHER INDUSTRIES

They also point out that some talent such as “experienced executives in emerging markets may not be available, so you may need to hire and then develop promising people.”

Therefore, employers need to re-examine their assumption that only someone with “direct” experience would be a valuable addition to their team.

There is strong evidence to support the merits of recruiting from other industries. The need for cross-functional skills has seen more executives moving between sectors.

This applies to various industries. For example, in a 2020 report, Global Executive Search firm SRI claimed that eight of 20 of the largest global sports leagues have cross-industry CEOs.

The changing landscape has emphasised the need for innovation and fresh perspectives. Hiring people who have achieved success in other industries is likely to increase your chances of coming up with new solutions to your business challenges.

We advise a focus on an individual’s transferable skills, competencies and key traits. Technical skills can be learnt. Potential, aptitude, adaptability, resilience and motivation are more elusive.

EVOLVING ROLES REQUIRE A FLEXIBLE TALENT STRATEGY

Corporate firms have taken the approach of spotting and hiring talent from the pool of financiers with whom their firms have worked. Others have poached talent from consulting firms that they have partnered with.

Banks are also no longer just relying on banking professionals and are instead looking at industry experts in various fields.

Roles that could benefit from this approach include but are not limited to:

- Supply Chain Managers <-> Product Managers <-> Procurement

- Operations Excellence <-> Programme Directors <-> Strategy Consulting

- Banking Relationship Managers <-> Trade Finance Managers <-> Pricing Managers <-> Treasury

- Treasurers/Liquidity Managers <-> Financial Controllers <-> Risk Managers

- Technology <-> Operations

- New Tech: Big Data <-> Pricing <-> Risk Management

- New Tech: Blockchain <-> Payments <-> Pricing

- New Tech: Robotics <-> IoT

THE GROWTH OF “HYBRID PROFESSIONALS”

Going forward, cross-functional expertise will indeed be the order of the day. For instance, banks that are in need of Relationship Managers to sell tech-based user-friendly products would benefit from hiring someone who has spent a few years as a Tech Business Consultant in any industry.

As the lines between Technology and Operations continues to grow, we recommend stretch assignments. Have your Head of Technology manage the Operations team and vice versa. Perhaps one day, your Chief IT Officer could also function as your Global Head of Pricing.

An uncertain and ambiguous future requires flexibility and adaptability on all fronts, not just in terms of technology acquisition, but also in terms of spotting, hiring and nurturing human capital.

Leave A Reply